قمة 10 الدول المنتجة للألمنيوم في 2023

قمة 10 الدول المنتجة للألمنيوم في 2023

قمة 10 الدول المنتجة للألمنيوم في 2023

حيث أن الألومنيوم موصل جيد للكهرباء وأقل تكلفة من النحاس والمعادن الأخرى الأكثر تكلفة, وغالبا ما يستخدم في خطوط نقل الكهرباء.

يستخدم الألومنيوم أيضًا كسبائك في صناعة الصلب, خلط مع أقوى, less malleable metals like copper, manganese, magnesium and silicon.

This increases strength, but allows the material to remain relatively light. One last benefit of aluminum is its high recovery rate.

Because the silvery metal can be recycled time and time again, it has as much as 95 percent energy savings compared to the energy used in primary production.

Where is aluminum found in the world?

While it is one of the Earth’s most abundant metals, aluminum is rarely found as a free metal.

That means companies can’t actually mine for the metal itself — instead, they mine bauxite, which is a large source of the world’s aluminum production.

The bauxite is processed to obtain alumina, which is then refined further through smelting to produce aluminum.

According to the US Geological Survey, “As a general rule, 4 tons of dried bauxite is required to produce 2 طن من الألومينا, which, فى الاعاده, can be used to produce 1 ton of aluminum.”

There are other sources of alumina, including clay and oil shale, but they are not economical at a commercial scale.

The US Geological Survey estimates global bauxite resources to be between 55 billion and 75 billion metric tons with deposits distributed largely in Africa, Oceania, South America, the Caribbean and Asia.

Known bauxite reserves stood at 30 billion metric tons in 2023.

The five nations with the highest bauxite reserves are Guinea, Vietnam, Australia, Brazil and Jamaica.

In terms of bauxite production, Australia was the world’s largest producer in 2023 at 98 million metric tons of bauxite, closely followed by Guinea at 97 million MT and China at 93 million MT.

Brazil and India round out the top five with 31 million and 23 million metric tons of bauxite respectively.

The next step is processing bauxite ore into alumina.

China is by far the world’s largest alumina producer, accounting for nearly 59 percent of the world’s production at 82 million metric tons.

The next largest alumina producing country, Australia, accounts for more than 13 percent of global supply with 19 million MT. Brazil, India and Russia round out the top five.

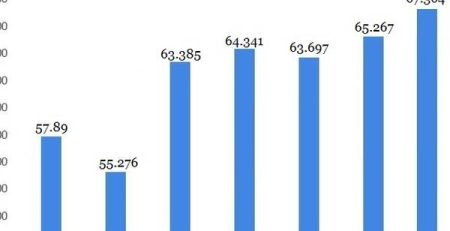

Aluminum production by country

The US Geological Survey notes that world aluminum output increased slightly in 2023, coming in at 70 million metric tons (MT) compared to 68.4 million MT in 2022.

Below is a look at the nations that make up the world’s top aluminum-producing countries.

1. الصين

Aluminum production: 41 million metric tons

First on this list of aluminum-producing countries is China, which produced 41 million metric tons of aluminum in 2023, more than half of total global production.

China also consumes a considerable amount of aluminum.

Statista points out that China has experienced consistent growth in primary annual aluminum production over the past decade.

كيفية اختيار آلة خبث الألومنيوم المناسبة لمشروعك 2023, China’s aluminum production increased to a record high for a second year in a row.

Production got a boost from “strong operations in some of China’s main producing regions, amid profitable conditions, and new projects, chiefly in the northern Inner Mongolia region, that came online,” Reuters reported.

2. الهند

Aluminum production 4.1 million metric tons

The second largest aluminum producer is India, which produced 4.1 million metric tons of aluminum in 2023.

India has also seen its output grow consistently in recent years. كيفية اختيار آلة خبث الألومنيوم المناسبة لمشروعك 2021, its production totaled 3.97 million MT, overtaking Russia, and over the past two years, India has increased its aluminum production even further.

Hindalco Industries (NSE:HINDALCO), the world’s leading aluminum-rolling company, is located in Mumbai.

فيدانتا (NSE:VEDL), India’s largest aluminum-producing company, expects to invest US$1 billion in its aluminum operations in 2024.

Indian exports are not expected to be heavily impacted by European Union carbon taxes on direct emissions set to go into effect in 2026.

The EU is the second largest aluminum consuming region in the world.

3. Russia

Aluminum production: 3.8 million metric tons

Last year, Russia produced 3.8 million metric tons of aluminum, up slightly from the 3.7 million MT it put out in 2022.

Leading global aluminum producer RUSAL is headquartered in Moscow.

Russia’s aggressive war in Ukraine and the resulting sanctions were expected to curb the country’s ability to contribute aluminum supply to the global aluminum market; ومع ذلك, China is picking up much of the slack. Rusal has reported that its year-on-year revenues for aluminum exports to China almost doubled in 2023.

4. Canada

Aluminum production: 3 million metric tons

Canada’s aluminum production was 3 million metric tons in 2023, up from the previous year’s total of 2.77 million MT of aluminum. ريو تينتو (ASX:RIO,NYSE:RIO,LSE:RIO), another leading global aluminum producer, has roughly 16 operations in the country.

The province of Québec is the main aluminum jurisdiction in Canada.

There are 10 primary aluminum smelters in Canada, with nine of those being located in Québec, and the province is also home to an alumina refinery.

The final smelter is located across the country in the province of British Columbia.

Canada was again the leading supplier of imported aluminum for the US in 2023, accounting for more than half of all imports.

5. United Arab Emirates

Aluminum production: 2.7 million metric tons

Fifth on this list of aluminum-producing countries is the United Arab Emirates (UAE), which produced 2.7 million metric tons. Aluminum production in the UAE has remained steady over the last few years, and came in at 2.65 million MT in 2022.

Emirates Global Aluminum is the largest aluminum producer in the Middle East and contributes nearly 4 percent of all global aluminum.

The UAE was the source of 8 percent of US aluminum imports in 2023.

6. Bahrain

Aluminum production: 1.6 million metric tons

Bahrain’s aluminum production came in at 1.6 million metric tons in 2023, on par with the previous year, when it overtook Australia for the sixth spot.

The aluminum sector is one of the largest sources of export revenue for Bahrain, taking in US$3 billion in 2023.

Formed in 1981, the Gulf Aluminium Rolling Mill in Bahrain was the first aluminum facility in the Middle East.

The downstream has an annual production capacity of more than 165,000 metric tons of flat-rolled aluminum products.

7. Australia

Aluminum production: 1.5 million metric tons

Australia’s aluminum production was down marginally in 2023 at 1.5 million metric tons compared to 1.51 million MT the previous year.

In addition to its work as a major aluminum producer in Canada, Rio Tinto also produces the industrial metal in Australia at two of the country’s four aluminum smelters.

The mining major sees aluminum as a valuable resource in the new automotive industry.

لماذا نحتاج إلى آلة طحن وتنظيف عيوب سطح الألومنيوم, Australia’s aluminum market has been struggling under the weight of the heavy energy costs associated with smelter operations for a number of years now.

“Australia is one of the world’s most emissions-intensive aluminium producers,” as per the Institute for Energy Economics and Financial Analysis.

Pittsburgh-based Alcoa (NYSE:AA), another of the world’s largest aluminum producing companies, operates the Kwinana refinery in Western Australia.

In January, the firm announced it plans to close up shop at Kwinana later in 2024 due to challenging economics.

8. Norway

Aluminum production: 1.3 million metric tons

Aluminum production in Norway declined in 2023 خبث أبيض وخبث أسود 1.3 million metric tons, down from the 1.4 million MT produced in the previous year.

Norway is the largest exporter of primary aluminum in the European Union.

Norsk Hydro (OTCQX:NHYKF,OSE:NHY), a Norwegian aluminum and renewable energy company, has a number of aluminum projects and plants in the country.

At Sunndal, Norsk Hydro operates the largest primary aluminum plant in Europe.

In its bid to reach zero-carbon aluminum, Hydro announced in June 2024 that it is beginning a three-year industrial scale pilot that will test the use of green hydrogen to power aluminum recycling at the recycling unit in its Høyanger plant Norway.

9. Brazil

Aluminum production: 1.1 million metric tons

Brazil’s aluminum output in 2023 rose by more than 35 percent over the previous year to reach 1.1 million MT, and displace the United States from the ninth top spot for global production.

The country is home to the world’s third largest bauxite reserves, and was the fourth largest bauxite production and third largest alumina production levels by country in 2023.

This makes the likelihood of Brazil gaining a further footprint in the global aluminum market very possible, especially given plans by the country’s industry leaders to invest R$30 billion in the domestic market by 2025.

The largest producer of primary aluminum in Brazil is Albras, which has annual production of about 460,000 metric tons of aluminum using renewable energy sources.

Albras is a 51/49 joint venture between Norsk Hydro and Nippon Amazon Aluminum Co. (NAAC), a consortium of Japanese companies, trading companies, consumers and manufacturers of aluminum products.

In August 2024, Mitsui & Co (TSE:8031) increased its stake in NAAC from 21 خبث أبيض وخبث أسود 46 percent in order to increase its offtake of green aluminum.

10. Malaysia

Aluminum production: 980,000 metric tons

Malaysia rounds out the top 10 list of largest aluminum producing countries with 980,000 metric tons of output.

The Southeast Asian nation’s output of the metal has boomed dramatically in the last decade; Malaysia’s aluminum production in 2012 was just 121,900 MT.

Aluminium Company of Malaysia, or Alcom, is both the largest producer of rolled aluminum products in the country and Malaysia’s largest aluminum producer.

It is part of the holding company Alcom Group (KLSE:2674).

س&P Global reports that Chinese firms are keen on opening aluminum smelting operations in Malaysia.

This includes the Bosai group, which is planning a 1 million MT per year operation in the country.